On Ethereum, MEV (Maximal Extractable Value) has a reputation problem. Frontrunning bots, sandwich attacks, and opaque dark pools extract billions while degrading user experience. But on Solana, MEV works differently—and the difference matters.

Thanks to Jito Labs' innovations in block building and stake-weighted quality of service, Solana has transformed MEV from a toxic externality into a sustainable revenue stream that flows back to stakers and improves network economics. Here's how it works.

What Is MEV?

MEV refers to profit extracted by reordering, including, or excluding transactions within blocks. Classic examples:

- Arbitrage: Spotting price differences between DEXs and executing profitable trades

- Liquidations: Being first to liquidate undercollateralized positions in lending protocols

- Sandwich attacks: Frontrunning a user's trade, executing your own, then backrunning to profit from slippage

On Ethereum, this created a dark forest where sophisticated bots extracted value at users' expense. Flashbots attempted to democratize access, but MEV remained largely extractive.

Solana's Structural Advantages

Solana's architecture makes toxic MEV harder:

- 400ms block times: Less time for frontrunning and sandwich attacks

- Parallel execution: Transactions don't queue sequentially, reducing ordering advantages

- Lower gas fees: Makes gas auction wars less profitable

- Fee market design: Priority fees are transparent and predictable

But MEV still exists. The question is: who captures it, and how?

Enter Jito Labs

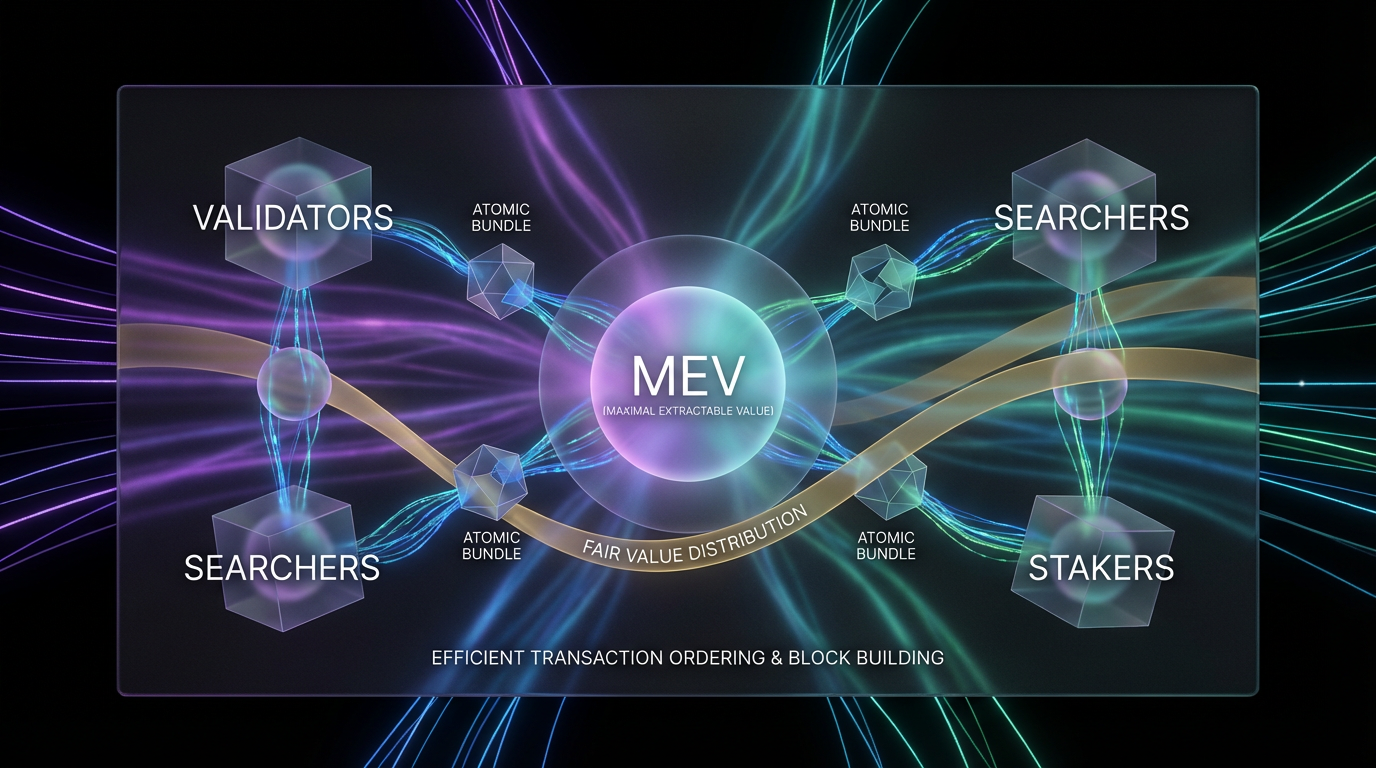

Jito Labs built infrastructure that makes MEV transparent, accessible, and redistributive. Their innovations:

1. Jito-Solana Client

A modified validator client that enables block building optimization. Validators running Jito-Solana can:

- Receive transaction bundles from searchers

- Execute bundles atomically (all-or-nothing)

- Capture MEV tips paid by searchers

- Redistribute tips to stakers

Result: ~80% of Solana stake now runs Jito-Solana, creating a liquid MEV marketplace.

2. Block Engine

A central auction system where searchers submit bundles. The Block Engine:

- Validates bundles for correctness

- Routes to the next scheduled leader

- Ensures only profitable bundles execute

- Distributes tips transparently

This creates a competitive MEV market where searchers bid for inclusion, validators earn extra yield, and stakers benefit.

3. Stake-Weighted QoS

Solana's Quality of Service (QoS) system prioritizes transactions based on staked SOL. Jito extended this:

- Searchers stake SOL to improve bundle delivery

- Higher stake = better latency and inclusion rates

- Creates economic incentive to hold SOL

This aligns MEV extractors with network security—searchers must stake to compete effectively.

The JitoSOL Flywheel

Jito's liquid staking token, jitoSOL, captures MEV rewards and distributes them to holders:

- Base staking yield: ~7% APY from Solana inflation

- MEV tips: Additional 1-3% APY from Jito tips

- DeFi composability: Use jitoSOL as collateral while earning yield

The result: jitoSOL has become Solana's dominant liquid staking token, with over $2B TVL. MEV rewards flow to stakers rather than bots.

Real-World MEV Examples on Solana

DEX Arbitrage

When USDC/SOL prices differ between Jupiter, Orca, and Raydium, arbitrageurs:

- Submit atomic bundles via Jito

- Execute trades across multiple DEXs

- Pay tips from profit to validators

- Keep remaining profit

This is positive-sum: prices converge faster, liquidity providers earn fees, validators get tips, and searchers profit.

Liquidation MEV

In lending protocols like MarginFi or Solend, liquidators compete to close undercollateralized positions:

- Monitor positions on-chain

- Submit liquidation bundles when collateral < debt

- Earn liquidation bonuses (typically 5-10%)

- Pay tips to validators from profits

Fast liquidations protect protocol solvency and prevent cascading failures.

NFT Sniping

When valuable NFTs are listed below floor price:

- Bots detect mispriced listings

- Submit purchase bundles with high tips

- Compete for inclusion in the next block

- Relist at market price

While this can feel unfair to manual buyers, it corrects pricing inefficiencies and generates tips for the network.

The Dark Side: What Jito Prevents

Jito's design explicitly prevents toxic MEV:

- No sandwich attacks: Bundles can't wrap around user transactions in the mempool

- Atomic execution: Bundles execute fully or revert, preventing partial exploitation

- Transparent tips: All MEV payments are visible on-chain

- Stake requirements: Malicious actors must hold SOL, aligning incentives

This creates a MEV ecosystem focused on positive-sum activities (arbitrage, liquidations) rather than zero-sum extraction (sandwiching).

MEV by the Numbers

Jito's dashboard shows MEV activity in real-time:

- Daily tips: $50K-$150K paid to validators

- Bundle success rate: ~15-20% (high competition)

- Searchers: 200+ active addresses submitting bundles

- jitoSOL APY boost: 1-3% above base staking yield

Compare this to Ethereum, where MEV extraction reached $600M+ in 2023 but flowed primarily to sophisticated actors, not everyday stakers.

The Future of MEV on Solana

Several developments will shape Solana's MEV landscape:

1. Firedancer Impact

Jump Crypto's new validator client will dramatically increase throughput. More transactions = more MEV opportunities, but also more competition among searchers.

2. Cross-Program MEV

As DeFi composability increases, multi-protocol arbitrage will become more sophisticated. Example: flash loan → borrow on MarginFi → arbitrage on Jupiter → repay → keep profit.

3. Intent-Based Architectures

Projects like Phoenix and Drift are experimenting with intent-based trading where users specify outcomes ("swap 100 SOL for best USDC price") and solvers compete to fulfill orders. This shifts MEV capture to solvers who provide best execution.

4. Privacy and MEV

Private mempools (where transactions aren't publicly visible before inclusion) could emerge. This would reduce frontrunning but might centralize MEV extraction.

Developer Considerations

If you're building on Solana:

- Design MEV-aware protocols: Assume searchers will optimize around your contracts

- Use Jito bundles: For atomic multi-step operations (minting + listing NFTs, complex DeFi strategies)

- Consider slippage protection: Even without sandwiching, price impact matters

- Monitor MEV analytics: Track how searchers interact with your protocol

Good protocol design can capture MEV for users. Example: CoW Swap on Ethereum returns MEV to traders by batching orders.

The Bottom Line

MEV isn't going away—it's a fundamental byproduct of decentralized finance. But Solana's approach, enabled by Jito Labs, shows how to make it transparent, fair, and redistributive.

Instead of toxic value extraction, Solana has built a positive-sum MEV ecosystem where:

- Searchers earn profits by improving market efficiency

- Validators receive tips beyond base rewards

- Stakers earn enhanced yields through jitoSOL

- Protocols benefit from faster arbitrage and liquidations

- Users get better execution and reduced slippage

This is blockchain economics done right: aligning incentives so that profit-seeking behavior strengthens the network rather than degrading it. As Solana scales with Firedancer and DeFi grows more sophisticated, this MEV infrastructure will become increasingly important—not just for extracting value, but for distributing it fairly across the ecosystem.

The next time you stake SOL or trade on a DEX, remember: MEV is happening in the background, but on Solana, it's working for you.