Maximal Extractable Value (MEV) has become one of the most talked-about topics in blockchain economics. On Solana, the MEV landscape looks fundamentally different from Ethereum—faster block times, parallel processing, and a unique validator architecture create distinct opportunities and challenges.

What Makes Solana's MEV Different?

Unlike Ethereum's mempool where pending transactions sit visible to searchers, Solana's architecture processes transactions at lightning speed with 400ms block times. This compressed timeframe changes the MEV game entirely—traditional frontrunning strategies need to operate in milliseconds rather than seconds.

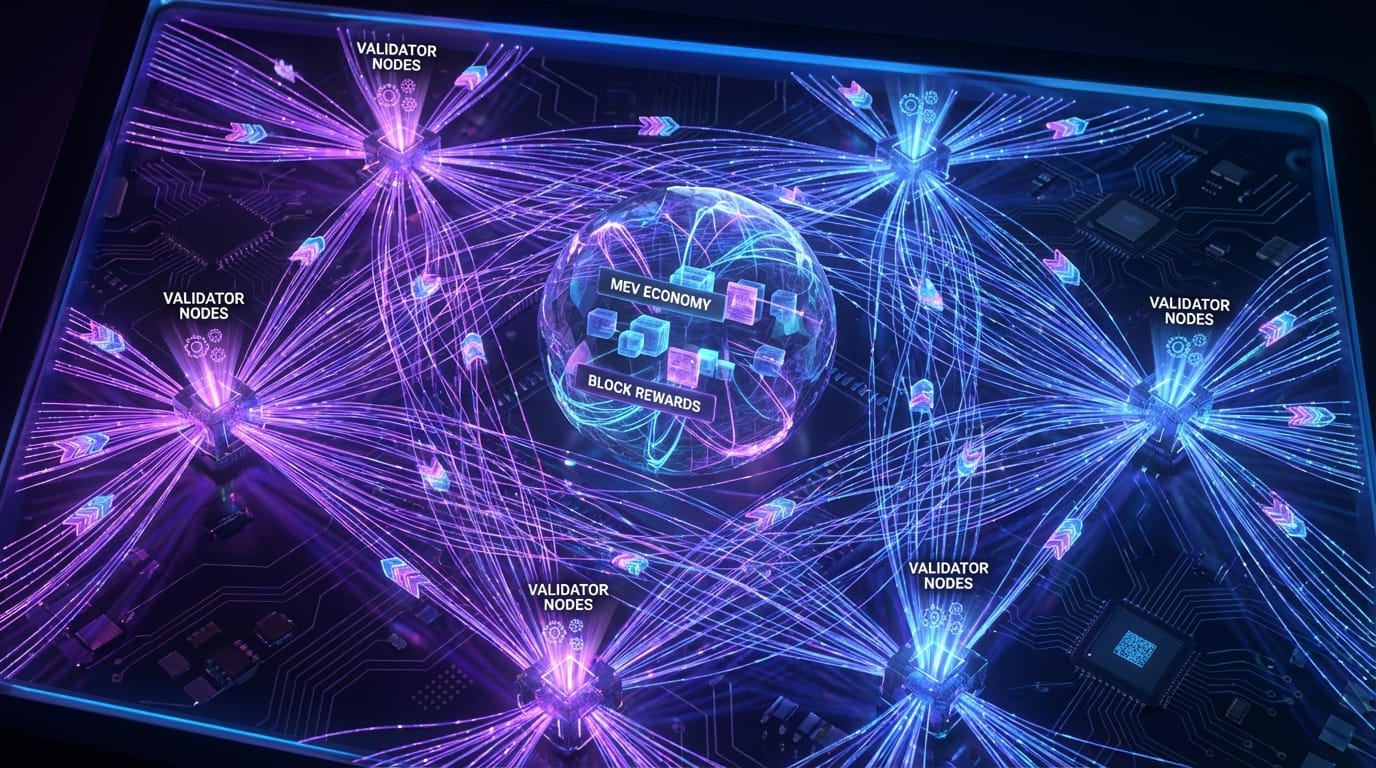

Solana validators don't have a public mempool. Instead, they receive transactions through a leader schedule system where specific validators produce blocks in rotating slots. This creates a more structured MEV environment where validators and searchers must coordinate differently than on other chains.

Jito: Building MEV Infrastructure

Jito Labs has emerged as Solana's primary MEV infrastructure provider, running a modified validator client that enables sophisticated transaction ordering. The Jito-Solana client allows validators to accept bundles—groups of transactions that must execute atomically in a specific order.

Through Jito's block engine, searchers can submit bundles directly to validators, paying tips for priority inclusion. This creates a more transparent MEV market where value flows to validators and, through liquid staking with JitoSOL, to stakers. Over $100 million in MEV tips have been distributed through this system since launch.

The system benefits all participants: searchers get reliable execution, validators earn additional revenue, and stakers receive MEV rewards through their liquid staking tokens. It's a more equitable distribution than the opaque MEV extraction seen on other chains.

Common MEV Strategies on Solana

Arbitrage remains the dominant MEV strategy. Solana's fast finality and low costs make cross-DEX arbitrage highly profitable. Searchers monitor price discrepancies across Jupiter, Raydium, Orca, and other protocols, executing trades within single blocks to capture spreads.

Liquidations in lending protocols like Solend and MarginFi create another MEV opportunity. Searchers monitor collateralization ratios and compete to liquidate undercollateralized positions, earning liquidation bonuses while keeping protocols healthy.

Backrunning on Solana involves executing arbitrage immediately after large trades that move prices. Unlike frontrunning (which harms users), backrunning actually helps markets by quickly correcting price dislocations without negatively impacting the original trader.

The Validator Economics Equation

Running a Solana validator involves significant hardware costs—high-performance servers, reliable bandwidth, and technical expertise. Validators earn revenue through:

- Staking rewards from inflation (currently ~5.5% APY)

- Transaction fees from processed transactions

- MEV tips from bundle execution (via Jito)

- Priority fees from users paying for faster inclusion

MEV tips have become a significant revenue source for validators running Jito clients. During high-activity periods, MEV can contribute 20-30% of validator income, making it an important factor in validator profitability and network decentralization.

The Debate: Is MEV Good or Bad?

MEV sparks heated debates in the crypto community. Critics point to frontrunning and sandwich attacks that extract value from users. Proponents argue that MEV incentivizes efficient markets and provides crucial additional revenue for validators.

On Solana, the fast block times and Jito's transparent bundle system actually reduce harmful MEV compared to other chains. Sandwich attacks are less profitable when blocks finalize in 400ms rather than 12 seconds. The bundle system also makes MEV more visible and distributable rather than captured by opaque actors.

Projects like Jupiter and Phoenix are building MEV-resistant DEX designs with Dutch auctions and frequent batch settlements. These innovations show how Solana's developer community is actively working to minimize negative MEV while preserving its benefits.

What's Next for Solana MEV?

The MEV landscape continues evolving. Firedancer's upcoming validator client will introduce new performance characteristics that may change MEV dynamics. Protocol-level improvements like local fee markets could further refine how MEV operates on Solana.

We're also seeing institutional interest in MEV as a yield strategy. Traditional finance firms are beginning to understand that MEV represents a legitimate market-making opportunity in decentralized systems—another sign of crypto's maturation.

As Solana's ecosystem grows, MEV will remain a critical component of network economics. The key is building infrastructure that distributes MEV fairly, protects users from harmful extraction, and supports the validator economics that keep the network secure. Jito and other projects are showing that with thoughtful design, MEV can be a feature rather than a bug.