Maximal Extractable Value (MEV) has become one of the most important—and controversial—topics in blockchain infrastructure. While Ethereum's MEV landscape is well-documented, Solana's approach to transaction ordering and value extraction is fundamentally different. Enter Jito, a protocol that's transforming how MEV works on Solana.

What is MEV?

MEV refers to the profit that can be extracted by reordering, including, or excluding transactions within a block. On traditional blockchains, this often manifests as:

- Arbitrage opportunities: Exploiting price differences across DEXs

- Liquidations: Being first to liquidate undercollateralized positions

- Sandwich attacks: Front-running and back-running user trades

On Ethereum, MEV extraction often happens through private transaction pools (like Flashbots), where validators receive bundles of transactions designed to capture value. This creates an opaque system where users can't always predict transaction outcomes.

MEV on Solana: A Different Beast

Solana's architecture makes MEV fundamentally different from Ethereum:

- 400ms block times: Much faster than Ethereum's 12 seconds, reducing time-based arbitrage windows

- Parallel transaction processing: Solana's Sealevel runtime executes non-conflicting transactions simultaneously

- No mempool: Transactions go directly to validators, making traditional front-running harder

- Leader rotation: Block producers change rapidly, limiting validator-specific MEV strategies

However, MEV still exists on Solana. Validators can still reorder transactions within their leader slots, and sophisticated bots compete for arbitrage and liquidation opportunities. The question became: how can we make this process more transparent and fair?

Enter Jito: Transparent MEV Infrastructure

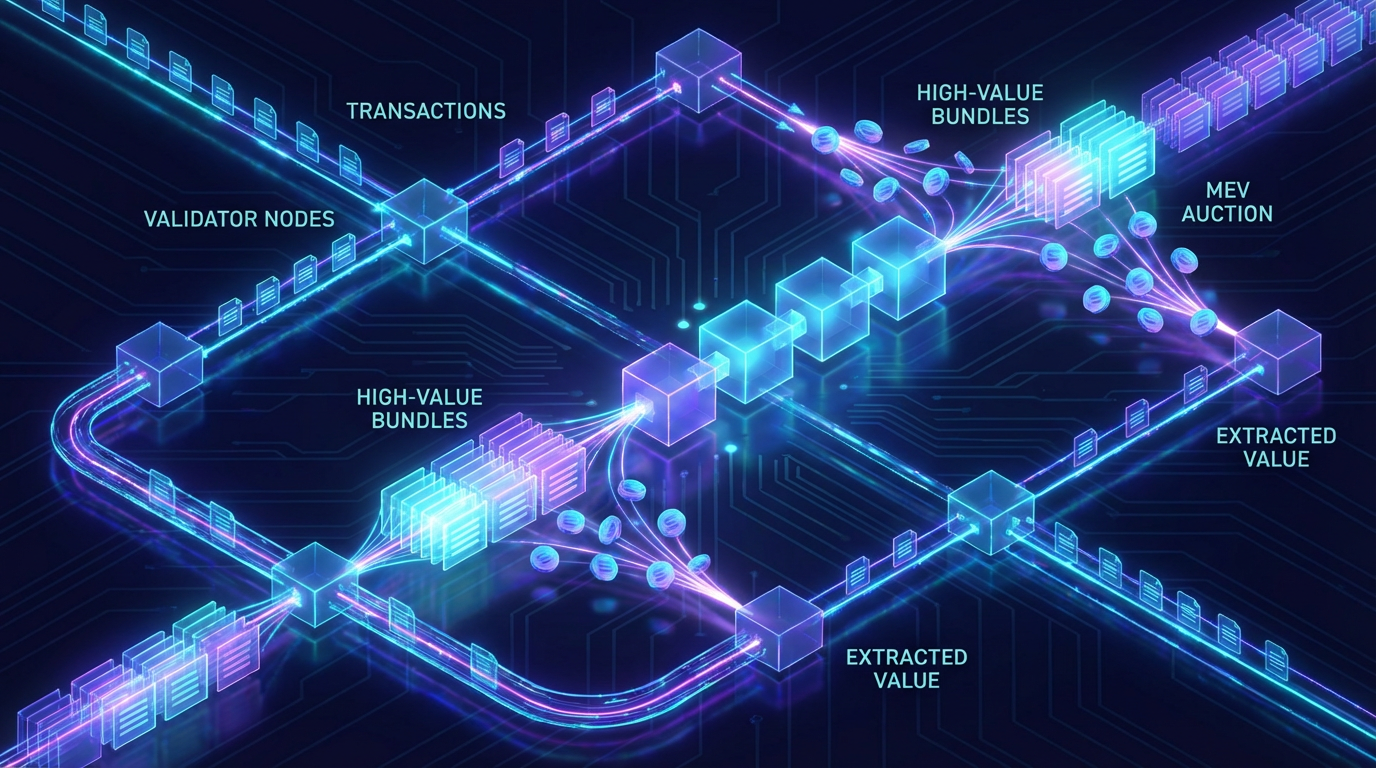

Jito Labs created an open-source validator client that introduces a transparent auction mechanism for transaction ordering on Solana. Here's how it works:

Block Engine Architecture

Jito's Block Engine sits between searchers (those looking for MEV opportunities) and validators. Searchers submit transaction bundles with tips, and the engine:

- Validates bundles to ensure atomic execution (all-or-nothing)

- Runs simulations to verify profitability

- Auctions block space to the highest bidders

- Forwards winning bundles to Jito validators

This creates a transparent marketplace where MEV opportunities are competed for openly, rather than extracted through opaque validator relationships.

Key Benefits

- Fair Competition: Anyone can submit bundles; no special validator relationships required

- Value Redistribution: Tips from searchers flow to validators and can be redistributed to stakers

- Transparency: On-chain visibility into MEV extraction and distribution

- Better Execution: Guaranteed bundle atomicity means complex multi-step transactions succeed or fail together

Jito's Impact on Solana

Since launching, Jito has become a critical piece of Solana's infrastructure:

- Validator Adoption: Major validators run Jito's client, representing significant network stake

- MEV Volume: Millions in daily MEV flows through Jito's infrastructure

- Staker Benefits: SOL stakers with Jito validators earn additional yield from MEV tips

- Ecosystem Development: Tools and services built around Jito's infrastructure (JitoSOL liquid staking, APIs, analytics)

The protocol has effectively created a new vertical within Solana's DeFi ecosystem, with dedicated searcher teams, analytics platforms, and educational resources.

MEV Types on Solana

Different types of MEV opportunities exist on Solana:

DEX Arbitrage

Price differences across Solana's many DEXs (Orca, Raydium, Jupiter aggregator routes) create arbitrage opportunities. Searchers use Jito bundles to execute multi-leg trades atomically, capturing profits while providing price consistency across markets.

Liquidations

DeFi lending protocols like Solend and Marginfi require timely liquidations of risky positions. MEV searchers compete to be first to liquidate, earning liquidation bonuses. Jito bundles ensure atomic execution—liquidate, repay debt, claim collateral—all in one transaction.

NFT Sniping

When valuable NFTs are listed below market price, bots race to purchase them first. On Solana's fast chain, this often comes down to transaction ordering and validator relationships—areas where Jito's transparent auction helps level the playing field.

Backrunning

Large trades create price impact. Searchers detect these transactions and immediately execute trades that profit from the temporary price change. Unlike sandwich attacks (which are harmful front-running), backrunning is generally considered acceptable as it helps markets find equilibrium.

Building with Jito: Developer Guide

If you're interested in building MEV strategies on Solana, here's the basic workflow:

- Opportunity Detection: Monitor on-chain data for arbitrage opportunities, liquidatable positions, etc.

- Bundle Construction: Create a bundle of transactions that atomically capture the value

- Tip Calculation: Add a tip payment to Jito's tip account to bid for block inclusion

- Bundle Submission: Send the bundle to Jito's Block Engine via their API

- Execution Monitoring: Track bundle status and adjust strategies based on success rates

Jito provides TypeScript and Rust SDKs to simplify bundle creation and submission. Their documentation includes examples for common MEV strategies.

The Economics of MEV

Understanding MEV economics is crucial for both searchers and users:

- For Searchers: Competition drives tips close to the total extractable value. You need efficient code, fast infrastructure, and sophisticated strategies to remain profitable.

- For Validators: MEV tips provide additional revenue beyond standard staking rewards. Running Jito's client can increase validator profitability by 10-20%.

- For Stakers: Staking with Jito validators or holding JitoSOL allows you to capture a share of MEV profits, boosting your effective yield.

- For Users: While some MEV is beneficial (arbitrage improves prices), sandwich attacks harm users. Jito's transparency helps identify and potentially discourage harmful MEV.

Challenges and Controversies

MEV infrastructure isn't without criticism:

- Centralization Concerns: Some worry that MEV infrastructure centralizes stake toward validators running specialized software

- Harmful MEV: Sandwich attacks and other exploitative strategies still exist, though they're more visible

- Network Complexity: Additional infrastructure adds complexity to Solana's already intricate architecture

- Barrier to Entry: Successful MEV searching requires significant technical expertise and capital

However, many argue that transparent MEV is preferable to the alternative—opaque extraction that benefits only those with insider relationships. At least with Jito, anyone can see what's happening and participate in the auction.

The Future of MEV on Solana

MEV infrastructure on Solana continues to evolve:

- Protocol Improvements: Jito continues enhancing its Block Engine with better bundle simulations and auction mechanisms

- Application-Layer Solutions: DEXs and DeFi protocols are building MEV-resistant designs (better AMM curves, time-weighted oracles)

- Network Upgrades: Solana's roadmap includes features that may impact MEV, like faster block times and improved transaction scheduling

- Tooling Maturity: Better analytics, simulation tools, and educational resources are making MEV more accessible

As Solana's DeFi ecosystem grows, MEV will likely become more sophisticated. The key question is whether transparent, competitive MEV (like Jito's model) can dominate over exploitative practices.

Conclusion

MEV is an inherent property of blockchains—as long as someone can influence transaction ordering, extractable value will exist. Jito's approach accepts this reality and builds infrastructure to make MEV extraction transparent, fair, and beneficial to the broader network.

For Solana developers and users, understanding MEV is crucial. Whether you're building DeFi protocols, running validators, or simply trading on-chain, MEV dynamics affect your experience. Jito's transparent auction model represents one of the most mature attempts to handle MEV responsibly—creating a system where value flows to those who contribute to network security, rather than being extracted by those with privileged access.

As Solana continues its mission to bring blockchain to billions, MEV infrastructure like Jito will play an increasingly important role in maintaining network efficiency, validator profitability, and user trust.