Solana's proof-of-stake consensus relies on a distributed network of validators who stake SOL tokens to secure the blockchain. Understanding validator economics is crucial for anyone considering staking, running a validator, or analyzing Solana's network security model.

Validator Participation Requirements

Running a Solana validator requires significant technical and financial resources. The hardware specifications are demanding:

- CPU: 12+ cores at 2.8GHz+ (AMD Ryzen or Intel Ice Lake recommended)

- RAM: 256GB minimum (512GB recommended for competitive performance)

- Storage: 2TB+ NVMe SSD with high IOPS for ledger and accounts database

- Network: 1Gbps+ symmetric bandwidth with low latency connections

- GPU: Not required for consensus but useful for transaction processing

Beyond hardware, validators need an initial stake to participate. While technically there's no minimum stake requirement, competitive validators typically attract 100,000+ SOL in delegated stake to be considered for leader slots regularly.

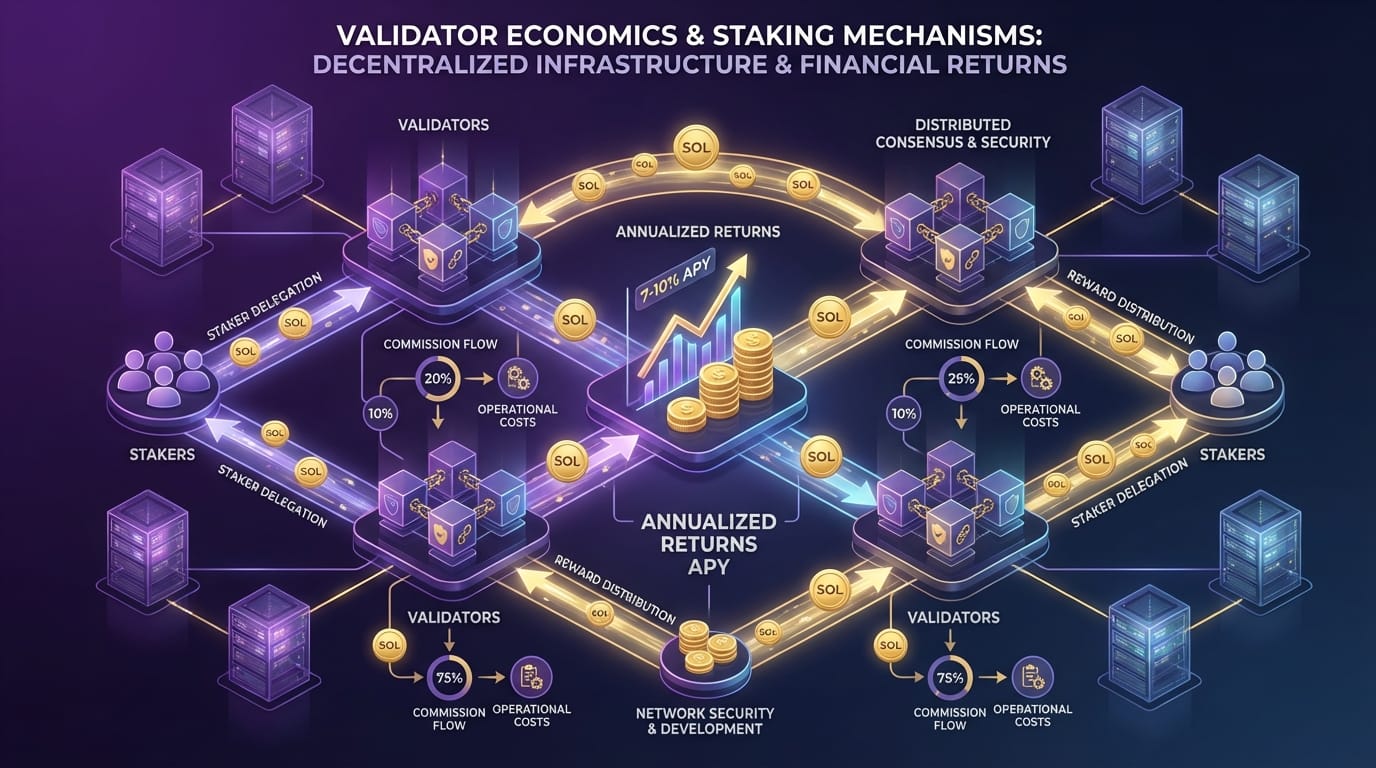

Inflation and Reward Distribution

Solana's tokenomics include a disinflationary schedule that started at 8% annual inflation and decreases by 15% each year until reaching a long-term stable rate of 1.5%. This inflation creates new SOL tokens that are distributed to validators and stakers as rewards.

Validator rewards come from two sources:

- Inflation rewards: Proportional to stake weight and vote credits earned

- Transaction fees: 50% of transaction fees are burned, 50% go to the leader validator

The inflation rewards are distributed based on vote credits, which validators earn by correctly voting on blocks during their assigned slots. A validator that maintains 100% uptime and votes on all blocks will maximize their vote credits and corresponding rewards.

Commission Structures and Delegator Returns

Validators set a commission rate that determines what percentage of rewards they keep before distributing the remainder to delegators. Commission rates on Solana typically range from 0-10%, with the network average around 7-8%.

For example, if a validator earns 1000 SOL in rewards during an epoch and has a 10% commission:

- Validator keeps: 100 SOL (10% commission)

- Remaining 900 SOL distributed proportionally to all stakers (including validator's self-stake)

Delegators should consider both commission rate and validator performance when selecting where to stake. A 0% commission validator with 95% uptime may provide worse returns than a 5% commission validator with 100% uptime.

MEV Extraction and Jito

Maximal Extractable Value (MEV) has become a significant revenue source for Solana validators. When a validator is elected as leader, they control transaction ordering within their blocks, creating opportunities to extract value through:

- Arbitrage: Profiting from price differences across DEXes

- Liquidations: Capturing liquidation bonuses from lending protocols

- Sandwich attacks: Front-running and back-running large trades

The Jito-Solana client has become the dominant MEV infrastructure, allowing validators to receive tip payments for transaction inclusion and ordering. Validators running Jito can earn substantially more than base inflation rewards, with top validators earning millions in annual MEV tips.

Jito validators can share MEV rewards with delegators, creating additional APY beyond standard staking returns. Some validators distribute 100% of MEV tips to stakers, while others keep a percentage.

Validator Performance Metrics

When evaluating validators, key metrics include:

- Vote credits: Higher is better, indicates consistent voting and uptime

- Skip rate: Percentage of leader slots where validator failed to produce a block

- Commission: Balance between competitive rate and sustainability

- Active stake: Total SOL delegated, affects leader slot frequency

- Data center concentration: Network health benefits from geographic decentralization

The Solana Foundation and ecosystem tools like StakeWiz, Validators.app, and Solana Beach provide dashboards for monitoring these metrics. Some validators publish detailed performance reports and uptime guarantees.

Stake Pool Programs

For delegators who want simplified staking, stake pool programs aggregate stake across multiple validators and provide liquid staking tokens. Popular examples include Marinade Finance, Jito, Lido, and BlazeStake.

Stake pools provide several advantages:

- Automatic diversification across multiple high-performing validators

- Liquid staking tokens (mSOL, jitoSOL, stSOL) that can be used in DeFi

- No unstaking period - instant liquidity through DEX swaps

- Automatic compounding of staking rewards

Trade-offs include additional smart contract risk, pool management fees (typically 1-2%), and less control over validator selection. Each stake pool uses different strategies for validator selection, balancing performance, decentralization, and network health.

Network Security Implications

Validator economics directly impact Solana's security model. A healthy validator economy should have:

- Decentralized stake distribution: No single validator or small group controlling >33% of stake

- Geographic diversity: Validators spread across data centers and jurisdictions

- Sufficient rewards to cover operational costs and incentivize professional operation

- Low barriers to entry for new validators to join and compete

The Solana Foundation runs a delegation program that stakes SOL with validators meeting performance and decentralization criteria, helping bootstrap new validators and encourage geographic diversity. Currently, over 1,900 validators secure the network, with the Nakamoto coefficient (minimum validators needed to control 33% of stake) around 19.

As MEV rewards grow relative to inflation rewards, there's ongoing discussion about how to balance profitability for validators while preventing centralization pressures from MEV sophistication advantages.

Understanding Validator Economics

Solana's validator economics create a complex but robust incentive system. For delegators, understanding commission rates, performance metrics, and MEV sharing policies is crucial for maximizing returns. For aspiring validators, the high hardware requirements and competitive landscape demand professional operations and continuous optimization.

The evolution of MEV extraction through Jito has added a new dimension to validator profitability, with top validators earning significantly more than base inflation rewards. As the network matures, finding the right balance between validator profitability, network decentralization, and user experience will remain an ongoing challenge for the Solana ecosystem.