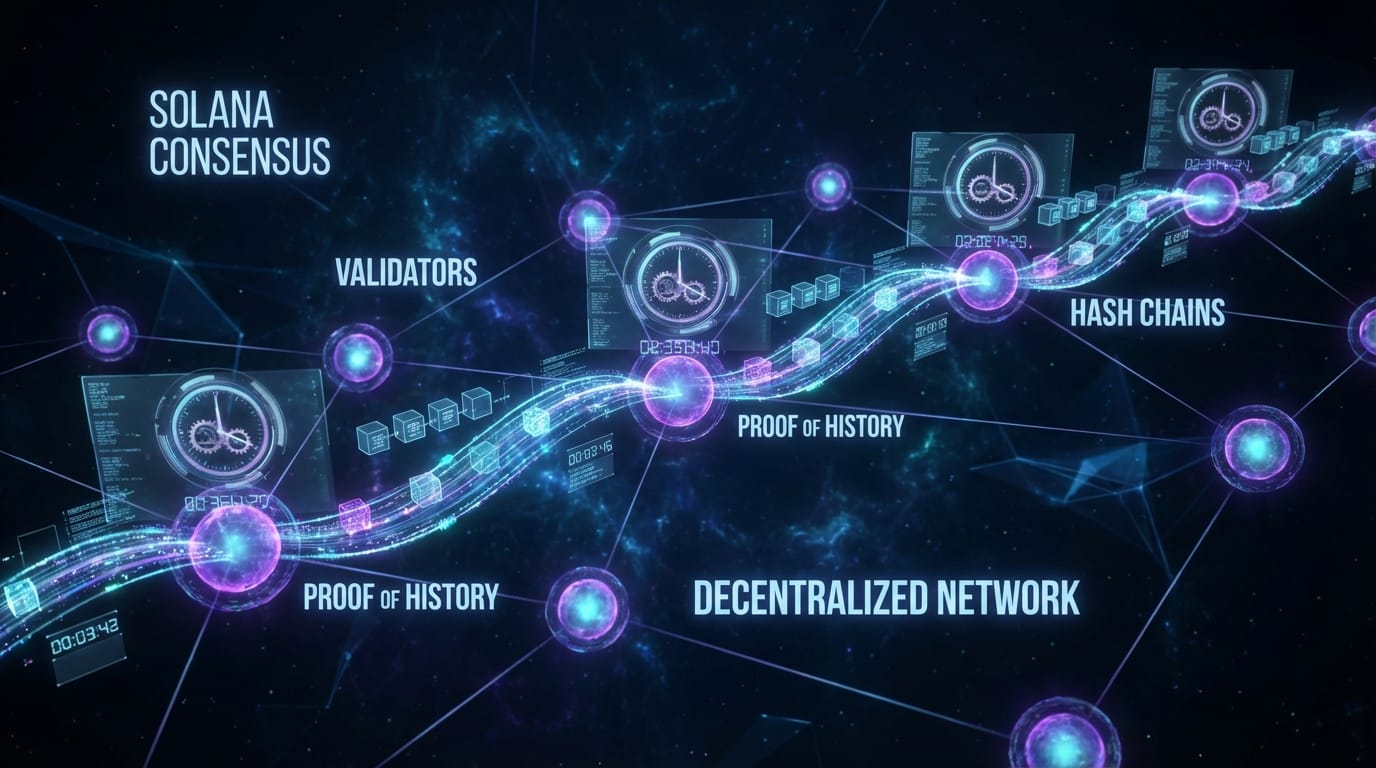

Solana's blazing speed isn't magic—it's the result of a revolutionary consensus mechanism that fundamentally reimagines how blockchains agree on transaction order. At its core lies Proof of History (PoH), a cryptographic innovation that acts as a decentralized clock, enabling validators to process transactions in parallel without waiting for network-wide coordination.

While other blockchains struggle with the blockchain trilemma, Solana's unique architecture achieves what many thought impossible: high decentralization, robust security, and unprecedented scalability—all at once.

The Proof of History Innovation

Proof of History is Solana's secret weapon. Unlike traditional blockchains that rely on timestamps from validators (which can be manipulated or inconsistent), PoH creates a verifiable sequence of events using SHA-256 hash functions.

Think of it as a cryptographic clock that ticks 400 times per second. Each "tick" is a hash that proves time has passed, creating an immutable historical record. This means validators can verify when transactions occurred without communicating, no need to wait for network-wide consensus on timestamps, transactions can be ordered and processed in parallel, and block times stay consistently under 400 milliseconds.

The PoH generator runs continuously, creating a hash chain where each output becomes the input for the next hash. This creates a verifiable delay function—you can't skip ahead or fake the sequence. Every transaction gets stamped with a PoH hash, permanently anchoring it in Solana's timeline.

Tower BFT: Proof of Stake Meets Proof of History

While PoH provides the clock, Solana still needs validators to agree on the state of the blockchain. Enter Tower BFT (Byzantine Fault Tolerance)—Solana's PoH-optimized version of Practical Byzantine Fault Tolerance (PBFT).

The leader validator (rotated every 4 blocks) receives transactions and orders them using PoH, bundles transactions into a block and broadcasts it. Other validators verify the PoH sequence and vote on the block. Votes are weighted by each validator's stake. Once 66.67% of staked validators confirm, the block is finalized.

Tower BFT uses PoH as a global clock, allowing validators to vote on multiple forks simultaneously while penalizing validators who vote for conflicting blocks. This "timeout mechanism" grows exponentially—the longer you've voted for a fork, the harder it becomes to switch, creating economic finality.

The Validator Network: Decentralization at Scale

As of 2026, Solana operates with over 3,000 validators distributed globally—one of the most decentralized networks in blockchain. Solana's Nakamoto Coefficient sits around 31, meaning you'd need to compromise 31 validators to attack the network—significantly higher than most PoS chains.

Running a Solana validator requires substantial hardware (12-core CPU, 256GB RAM, 2TB NVMe SSD), but this investment ensures validators can handle the network's throughput demands. Validators earn rewards through transaction fees and block rewards, currently averaging 6-7% APY.

Turbine: Block Propagation at Light Speed

With blocks being produced every 400ms, Solana needs to propagate them across thousands of validators instantly. Solana's solution is Turbine, a block propagation protocol inspired by BitTorrent. Instead of broadcasting entire blocks, Turbine breaks blocks into small packets (shreds), uses erasure coding so only 67% of shreds are needed to reconstruct the block, organizes validators into layers, with each layer forwarding shreds to the next, and reaches all validators in logarithmic time.

This means a 128MB block can propagate to 40,000 validators in under 500ms, even with 33% packet loss. Turbine is why Solana maintains sub-second block times at global scale.

Gulf Stream: The Mempool Killer

Most blockchains have mempools—waiting areas where transactions sit until validators include them in blocks. Solana eliminated the mempool entirely with Gulf Stream. Transactions are forwarded directly to the upcoming leader validators (known 4 blocks in advance thanks to PoH), validators can execute transactions before becoming leader, and by the time they're the leader, transactions are already processed. Confirmation happens in 400ms instead of minutes.

Gulf Stream enables validators to process 50,000 transactions per second per core, and with Firedancer's multi-core optimizations, this could scale to millions of TPS.

Sealevel: Parallel Smart Contract Execution

While Ethereum processes smart contracts sequentially (one at a time), Solana's Sealevel runtime executes them in parallel across all CPU cores. This is possible because Solana transactions must specify all accounts they'll read or write upfront. Combined with PoH's ordering, Sealevel achieves 65,000+ transactions per second in production, hundreds of thousands of TPS in testing, and linear scalability with hardware improvements.

This is why Solana can handle DeFi trading, NFT mints, gaming transactions, and payments simultaneously without congestion.

The Economic Security Model

Solana's security relies on staked SOL—currently over 365 million SOL staked (about 65% of circulating supply), representing over $50 billion in economic value. Validators earn 6-7% APY on staked SOL through inflation and fees, get slashed for malicious behavior or extended downtime, and benefit from network growth as more transactions mean more fees.

For token holders, you can delegate to validators without technical knowledge, earn staking rewards while maintaining liquidity through liquid staking, and vote through validators on network upgrades. The inflation schedule decreases annually, eventually settling at 1.5% long-term inflation. As transaction volume grows, fee revenue could exceed inflation, making SOL deflationary—similar to Ethereum post-merge.

Challenges and Ongoing Improvements

Solana's consensus isn't perfect. The network has faced challenges including network outages in 2022 (now resolved with better fork handling), validator hardware requirements (being addressed with Firedancer), state growth concerns (mitigated by state compression), and bot spam during NFT drops (improved with priority fees).

The Solana Foundation and community continue iterating with Firedancer (Jump Crypto's independent validator client with a 10x performance boost expected), QUIC protocol for better congestion handling and transaction prioritization, stake-weighted QoS to prevent sybil attacks while maintaining permissionlessness, and local fee markets for per-account congestion pricing.

Why This Matters for Developers and Users

Understanding Solana's consensus helps explain why it feels different from other blockchains. For developers, it means building applications that would be impossible elsewhere—real-time trading engines, on-chain order books, instant payment systems, and gaming experiences that don't feel like blockchain.

For users, it means transactions that confirm faster than a credit card swipe, fees measured in fractions of a cent, and applications that feel like Web2 while retaining Web3's self-custody and composability.

Solana's consensus isn't just faster—it enables entirely new categories of applications. As the network continues maturing with client diversity, improved reliability, and scaling innovations, the gap between Solana and other L1s will only widen. The blockchain trilemma isn't solved with compromises or Layer 2 workarounds. Solana's approach proves that with the right architectural decisions—Proof of History, parallel execution, and aggressive optimization—you can have all three at once.