Every blockchain faces a fundamental challenge: how to incentivize network security while maintaining long-term economic sustainability. Solana addresses this through a carefully designed economic model that balances validator rewards, network inflation, and ecosystem growth. Let's explore how Solana's tokenomics work and why they matter for the network's future.

The Inflation Schedule: Decreasing Over Time

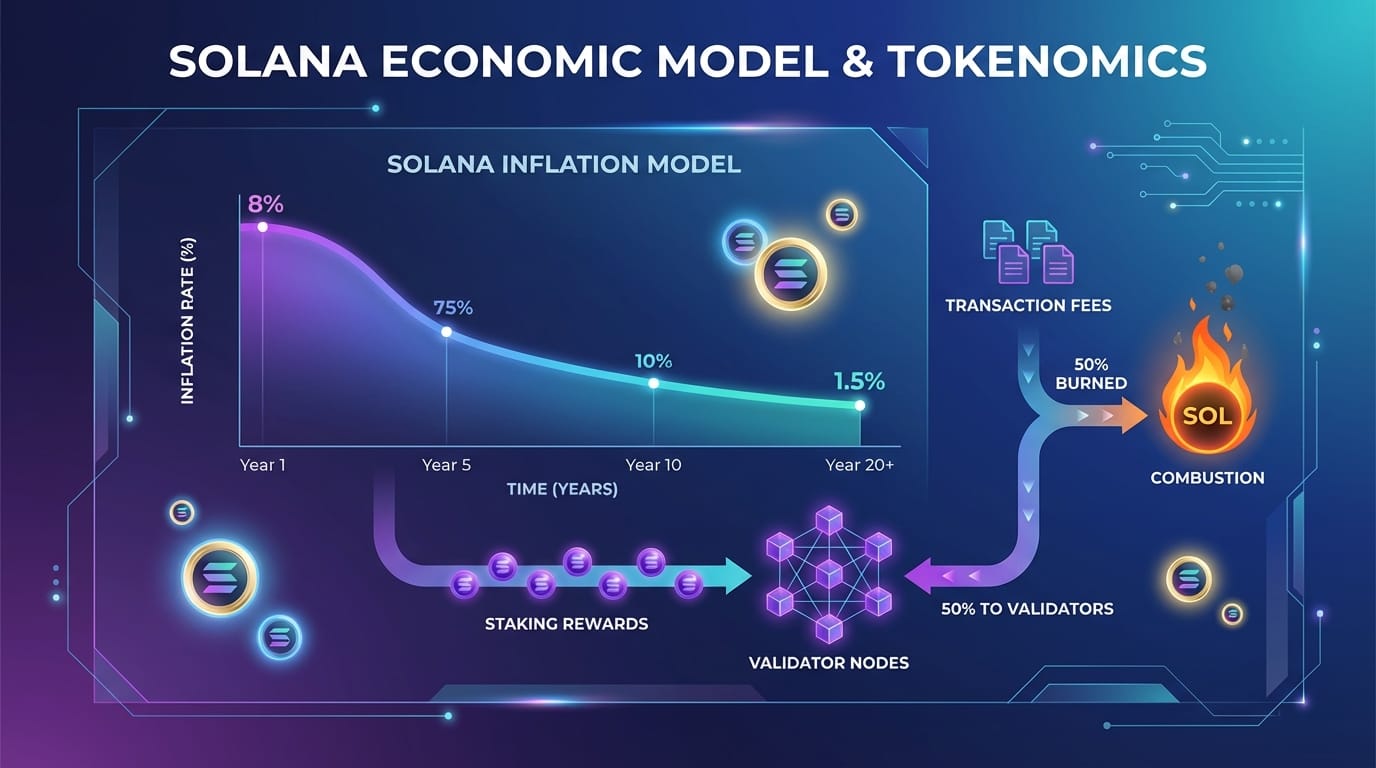

Solana launched with an initial inflation rate of 8% annually, but this isn't a fixed number. The protocol implements a disinflationary schedule that reduces the inflation rate by 15% each year until it reaches a long-term steady state of 1.5%.

This gradual reduction serves multiple purposes. In the early years, higher inflation provides substantial rewards to validators and stakers, encouraging network participation and security when the network is most vulnerable. As the network matures and transaction fees grow, the need for high inflation diminishes, allowing the economic model to shift toward fee-based rewards.

The math is straightforward but impactful:

- Year 1: 8% inflation

- Year 2: 6.8% (8% × 0.85)

- Year 3: 5.78%

- Continues decreasing until reaching 1.5% terminal inflation

How Staking Rewards Work

The inflation doesn't simply disappear into the ether—it goes directly to validators and their delegators as staking rewards. This creates a powerful incentive structure: stake your SOL to earn rewards and help secure the network, or hold unstaked tokens that gradually lose purchasing power relative to the total supply.

The actual return for stakers depends on the total percentage of SOL staked across the network. If 100% of SOL were staked, stakers would earn the full inflation rate. In practice, with approximately 65-70% of SOL typically staked, the effective annual percentage yield (APY) for stakers is higher than the base inflation rate.

For example, at 7% network inflation with 70% of tokens staked, the staking yield would be approximately 10% APY (7% ÷ 0.70). This calculation excludes transaction fees, which provide additional rewards to validators and their delegators.

Transaction Fees: The Path to Sustainability

While inflation provides the baseline rewards, transaction fees represent the future of validator economics. Every transaction on Solana pays a small fee—typically 0.000005 SOL (5,000 lamports) for a simple transfer, with more complex transactions costing proportionally more.

These fees are split: 50% is burned (permanently removed from circulation), and 50% goes to the validator that included the transaction in their block. This creates a deflationary pressure that can offset inflation when network activity is high enough.

During periods of extreme network activity, Solana has processed billions of transactions in a single day. At scale, these fees can become substantial—transforming from a minor addition to a primary revenue source for validators. This transition is crucial for long-term sustainability, as it means the network can maintain security and decentralization even as inflation approaches its 1.5% terminal rate.

Validator Economics: More Than Just Rewards

Running a validator on Solana isn't trivial. Validators need high-performance hardware, reliable internet, and technical expertise to maintain uptime and performance. The economic model compensates for these requirements through the combination of inflation rewards and transaction fees.

Validators also charge a commission on the staking rewards earned by their delegators—typically ranging from 0% to 10%. This creates a competitive market where validators balance their commission rates against the quality of their service. Delegators can freely choose validators and switch their stake if a validator's performance or commission doesn't meet expectations.

The stake-weighted leader schedule ensures that validators with more stake produce more blocks and earn proportionally more transaction fees. However, the Solana Foundation's delegation program helps bootstrap smaller validators, promoting decentralization by distributing stake more broadly across the network.

The Burn Mechanism and Net Inflation

An often-overlooked aspect of Solana's economics is the deflationary pressure from burned transaction fees. While the protocol mints new SOL through inflation, it simultaneously burns 50% of all transaction fees. The net inflation is therefore the gross inflation minus the burned fees.

During periods of exceptionally high activity, it's theoretically possible for Solana to become net deflationary—burning more SOL through transaction fees than is created through inflation. While this hasn't occurred at the network level yet, individual epochs have seen substantial burns that significantly reduced net inflation.

This dynamic creates an interesting equilibrium: as the network grows and processes more transactions, the deflationary pressure from burns increases, potentially offsetting much of the scheduled inflation. The result is a self-regulating system where network success directly impacts token economics.

Long-Term Sustainability

The brilliance of Solana's economic model lies in its evolution over time. In the early years, generous inflation rewards attract validators and stakers, building a robust and decentralized network. As the ecosystem matures and transaction volume grows, the economic incentives gradually shift from inflation-based to fee-based rewards.

By the time inflation reaches its 1.5% terminal rate, the network should be processing sufficient transaction volume to sustain validator operations primarily through fees. This creates a sustainable model where network security is directly tied to network usage—the more valuable and active the network, the more secure it becomes.

For SOL holders, understanding these economics is crucial. Staking isn't just about earning yield—it's about participating in network security and governance while avoiding the dilution from inflation. As Solana continues to scale and transaction volumes increase, the interplay between inflation, staking rewards, and fee burns will determine the real purchasing power of SOL over time.

The economic model represents a carefully balanced approach to blockchain sustainability—rewarding early participation while building toward a future where the network's utility sustains its security.