Staking has long been the foundation of proof-of-stake networks like Solana, allowing users to earn rewards by securing the network. But traditional staking comes with a catch: your tokens are locked, meaning you can't use them for anything else. Enter liquid staking—a revolutionary approach that's changing the game for Solana DeFi.

What Is Liquid Staking?

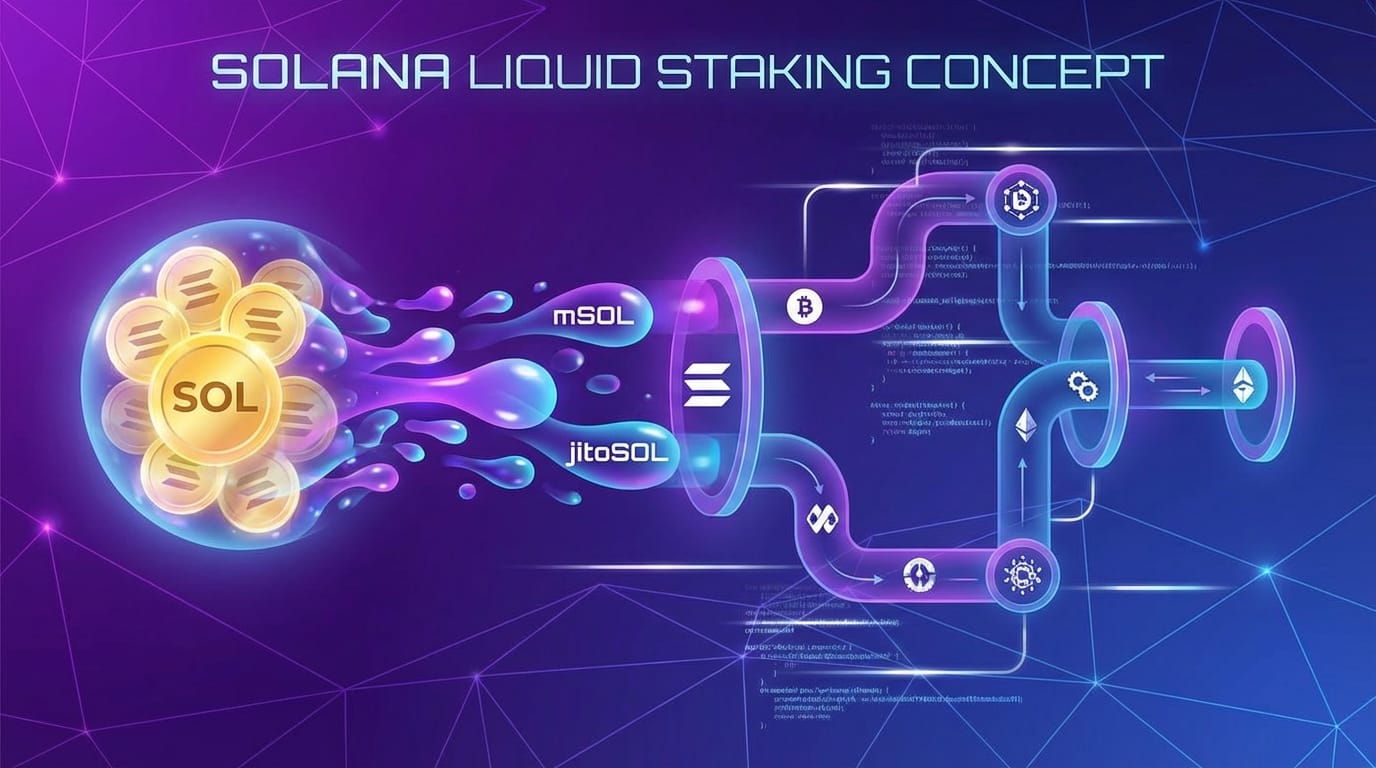

Liquid staking solves the capital lock-up problem by issuing liquid staking tokens (LSTs) that represent your staked SOL. These tokens accrue staking rewards over time while remaining fully tradeable and usable in DeFi protocols. It's like having your cake and eating it too—you earn staking yields while maintaining complete capital flexibility.

When you stake SOL through a liquid staking protocol, you receive an LST in return (like mSOL or jitoSOL). This token increases in value relative to SOL as staking rewards accumulate, and you can use it across the Solana DeFi ecosystem—as collateral in lending protocols, in liquidity pools, or simply hold it to compound your rewards.

The Leading Liquid Staking Protocols

Marinade Finance pioneered liquid staking on Solana with its mSOL token. The protocol automatically delegates your staked SOL across dozens of high-performing validators, promoting decentralization while optimizing for yield. With over $1.5 billion in total value locked, Marinade has become the backbone of Solana's LST ecosystem.

Jito takes liquid staking further by incorporating MEV (Maximal Extractable Value) rewards. Validators running Jito's client can capture MEV opportunities and distribute these extra earnings to jitoSOL holders. This often results in higher APY compared to standard staking, making jitoSOL increasingly popular among yield-conscious users.

Other notable players include BlazeStake with bSOL and Lido with stSOL, each offering unique features and validator delegation strategies.

DeFi Strategies with LSTs

The real power of liquid staking emerges when you put your LSTs to work in DeFi:

Lending and Borrowing: Protocols like Solend and MarginFi accept LSTs as collateral, allowing you to borrow against your staked position without unstaking. This enables leveraged strategies—borrow USDC against your mSOL, use it to buy more SOL, stake it for more mSOL, and repeat (within safe collateralization ratios).

Liquidity Provision: Provide liquidity for LST trading pairs on Orca, Raydium, or Meteora. For example, an mSOL-USDC pool lets you earn trading fees and liquidity mining rewards on top of your base staking yield. Some pools offer triple-digit APYs during high-activity periods.

Yield Aggregation: Platforms like Tulip Protocol automatically deploy your LSTs into the highest-yielding strategies, rebalancing as opportunities shift. This hands-off approach maximizes returns while minimizing the complexity of managing multiple positions.

Risks and Considerations

While liquid staking unlocks powerful opportunities, it's important to understand the risks:

Smart contract risk exists with any DeFi protocol. While major LST protocols have undergone extensive audits, bugs or exploits are always possible. Only use well-established protocols with proven track records.

Liquidity considerations matter when exiting positions. While most major LSTs have deep liquidity, during market stress you might face slippage when swapping back to SOL. Alternatively, you can always unstake through the protocol (though this requires the standard unstaking period).

Validator performance affects your yields. LST protocols delegate to multiple validators, but if these validators underperform or experience downtime, your rewards suffer. Reputable protocols actively manage their validator sets to mitigate this.

The Future of Solana Liquid Staking

As Solana's DeFi ecosystem matures, LSTs are becoming the base layer for capital efficiency. We're seeing innovations like LST derivatives, governance mechanisms for LST holders, and cross-protocol integrations that make LSTs more useful than ever.

The Sanctum protocol is building infrastructure for LST composability, creating unified liquidity across different LSTs and enabling seamless swaps between them. Projects like Drift are developing LST-based perpetual futures, allowing traders to gain leveraged exposure to staking yields.

For Solana users, the message is clear: there's no longer a choice between staking your SOL and using it in DeFi. Liquid staking lets you do both, maximizing your capital efficiency while contributing to network security. Whether you're a passive holder looking to earn yield or an active DeFi user seeking advanced strategies, LSTs have become an essential tool in the Solana ecosystem.